We have been tracking the news flow and experts’ opinions regarding the developments in global commodities markets for the past couple of years.

From our elementary understanding of economics and human behavior, we understand that aging demography, deeper & wider penetration of dematerialization & digitalization in human lives, rising awareness about climate change, and deteriorating growth potential of the developed economies, and perhaps China also, definitely do not augur well for the commodities’ demand in the long term (10-15yrs).

However, the opinion of experts is overwhelmingly in favor of a bull market in commodities in the short term (2-5yrs).

The key arguments presented by experts in favor of a bull market in commodities could be summarized as follows:

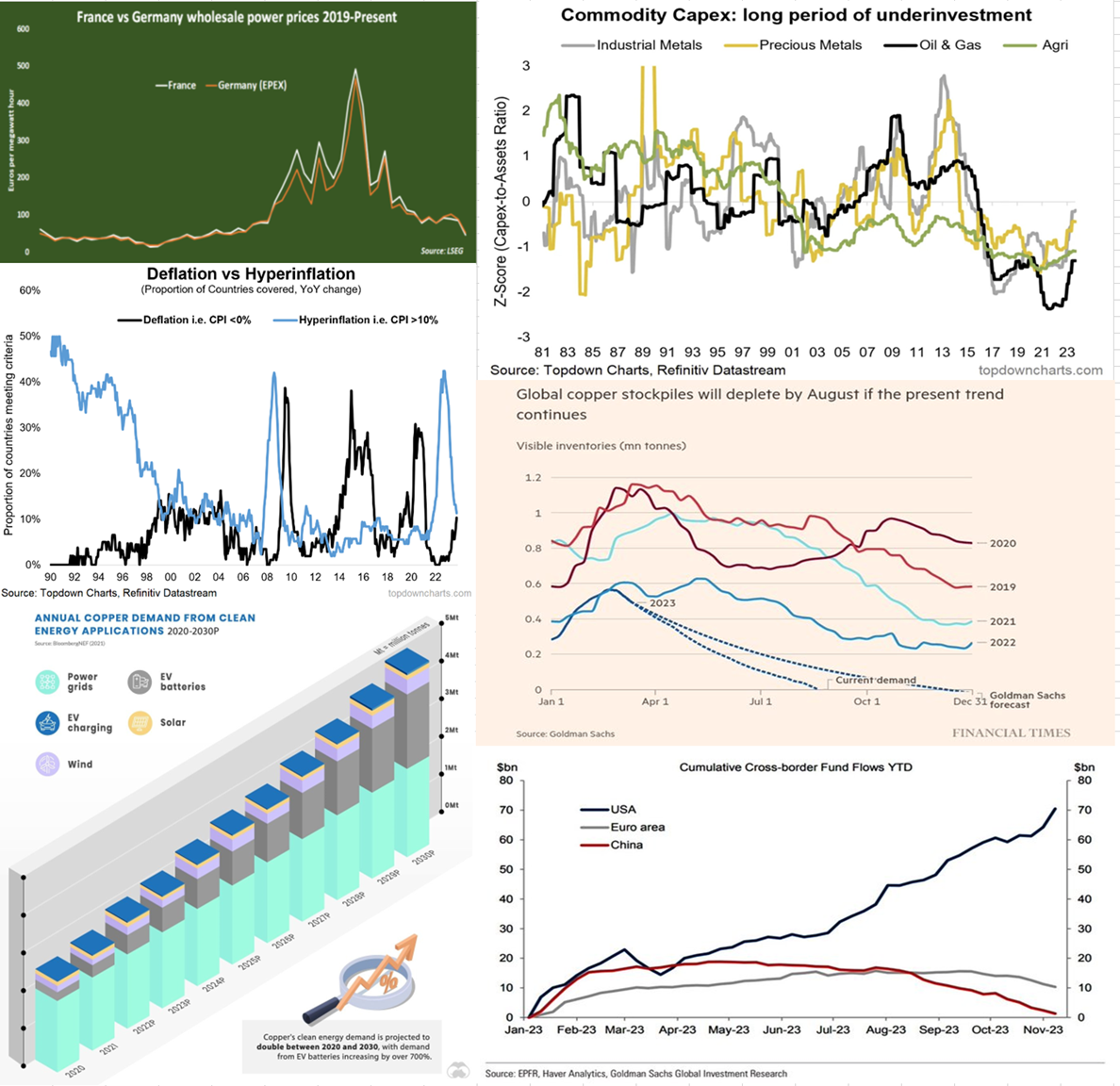

(a) Energy prices have corrected back to the pre-covid period. European power prices, US gas prices, natural gas prices, coal prices, and crude oil prices are back to more “normal” levels. The latest inventory, consumption, and production forecasts for 2024 and 2025 are indicating further easing in energy prices over the next couple of years. Energy being one of the major costs in the production of commodities, lower energy costs and adequate supply is a bullish argument for commodities.

(b) Focus on the use of clean energy, particularly for mobility and electricity production, is changing the demand mix for metals. The demand for metals like copper, aluminum, lithium etc. is rising much faster than the supply. The stockpiles are diminishing fast.

(c) Commodity producers, mostly emerging economies, are getting stronger in global strategic balance. The expansion of BRICS to include more commodity producers in the emerging market alliance is just one instance. These economies are now in a much better position in determining the terms of trade, which are dominated by the financialized developed world in the extant global order.

(d) The geopolitical conditions are worsening. Presently, two fronts (Palestine and Ukraine) are witnessing open war. The fear is that more fronts could open in the next couple of years as the political stands are hardening and no one is showing signs of backing out. Wars have been traditionally bullish arguments for commodities as demand for war equipment and reconstruction work need more metals and building materials.

(e) There is not much consensus on this point, but a strong view is that USD as a global currency may have peaked and could potentially see a steady decline over the next many years. The share of global trade invoiced in USD terms and USD reserves of global central bankers have witnessed a consistent decline in recent years. Moreover, the cross-border flow of funds from the US has witnessed a sharp rise in 2023. Unsustainable US public debt has led to a downgrade of the US sovereign rating outlook. Besides, the trade conflict with China has led to a conspicuous shift of technological advantage from the US to China. These trends may consolidate the position of commodity-producing emerging economies enabling them to seek favorable terms of trade.

We have avoided investment in commodity producers for a few years now but it is time for going overweight on metals/commodities in our investment strategy